Finance Working Papers,

University of Aarhus, Aarhus School of Business, Department of Business Studies

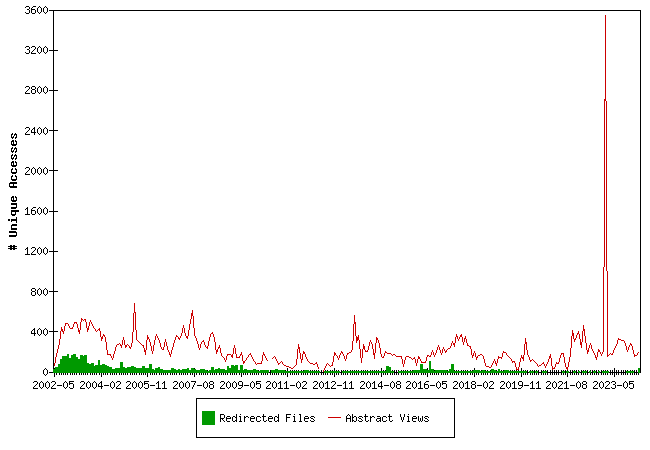

Downloads from S-WoBA

Fulltext files are files downloaded from the S-WoBA server, Redirected files are files downloaded from a server maintained by the publisher of a working paper series.

The statistics for 2010-06, 2012-04 (half month), 2012-05 and 2012-06 have unfortunately been lost. We regret this.

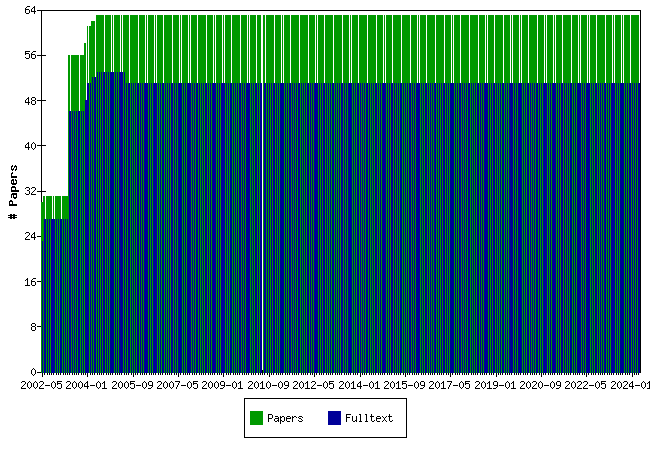

Papers at S-WoBA

Top papers by Abstract Accesses last month (2026-01)

Top papers by Downloads last month (2026-01)

Top papers by Abstract Accesses last 3 months (2025-11 to 2026-01)

| Paper | Accesses |

|---|---|

| Was the Honeymoon Effect Effective? An Analysis of the EMS Target Zone. Allan Bødskov Andersen | 109 |

| Testing for Multiple Types of Marginal Investor in Ex-day Pricing Jan Bartholdy, Kate Briown | 89 |

| Variable Bandwidth Kernel Hazard Estimators Jens Perch Nielsen | 85 |

| Valuation of Path-Dependent Interest Rate Derivatives in a Finite Difference Setup Mikkel Svenstrup | 84 |

| Cross-Currency LIBOR Market Models. Peter Mikkelsen | 81 |

| A Finite Difference Approach to the Valuation of Path Dependent Life Insurance Liabilities. Anders Grosen, Bjarke Jensen, Peter Løchte Jørgensen | 80 |

| Volatility-Spillover E ffects in European Bond Markets Charlotte Christiansen | 79 |

| The Pros and Cons of Butterfly Barbells Michael Christensen | 75 |

| Local Linear Density Estimation for Filtered Survival Data, with Bias Correction Jens Perch Nielsen, Carsten Tanggaard, M. C. Jones | 75 |

| The Relation Between Asset Returns and Inflation at Short and Long Horizons. Tom Engsted, Carsten Tanggaard | 72 |

Top papers by Downloads last 3 months (2025-11 to 2026-01)

Top papers by Abstract Accesses all months (from 2002-05)

Top papers by Downloads all months (from 2002-05)

| Paper | Downloads |

|---|---|

| Credit Spreads and the Term Structure of Interest Rates. Charlotte Christiansen | 393 |

| Revisiting the shape of the yield curve: the effect of interest rate volatility. Charlotte Christiansen, Jesper Lund | 382 |

| Cross-Currency LIBOR Market Models. Peter Mikkelsen | 368 |

| Implied Volatility of Interest Rate Options: An Empirical Investigation of the Market Model. Charlotte Christiansen, Charlotte Strunk Hansen | 353 |

| MCMC Based Estimation of Term Structure Models. Peter Mikkelsen | 247 |

| Evaluating Danish Mutual Fund Performance Michael Christensen | 218 |

| Evaluating the C-CAPM and the Equity Premium Puzzle at Short and Long Horizons: A Markovian Bootstrap Approach. Tom Engsted, Enno Mammen, Carsten Tanggaard | 196 |

| Quantifying the "Peso Problem" Bias: A Switching Regime Approach. Allan Bødskov Andersen | 188 |

| The Relation Between Asset Returns and Inflation at Short and Long Horizons. Tom Engsted, Carsten Tanggaard | 182 |

| The comovement of US and UK stock markets. Tom Engsted, Carsten Tanggaard | 171 |

- University of Aarhus, Aarhus School of Business, Department of Business Studies

- Home page for this series

Questions (including download problems) about the papers in this series should be directed to Helle Vinbaek Stenholt ()

Report other problems with accessing this service to Sune Karlsson ().

This page generated on 2026-02-01 05:59:30.